(

YicaiGlobal)

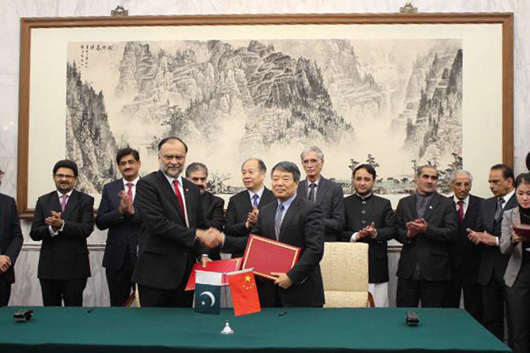

Jan. 11 — Chinese state-owned enterprise CITIC Group Corp. announced

this week it had acquired a 20-year franchise for McDonald’s restaurants

in both mainland China and Hong Kong at a price of USD2.08 billion,

jointly with several other parties. This hunt for buyers had lasted

almost a year, with a dozen companies and institutions in a row

participating in the bidding.

Noteworthy is that, Yum China Holdings Inc. (NYSE:YUMC), KFC’s

parent, announced its separation from Yum! Brands, Inc. (NYSE:YUM) a

month ago and its independent NYSE listing. Before listing, Yum China

once announced its decision to sell 20 percent of its stake.

These two fast food operators took similar actions. This was no

coincidence. We have therefore compiled five questions — possibly the

questions uppermost in everyone’s minds — to try to explain this matter.

1. Why did they sell their businesses?

The answer is quite simple. Fast food is not as popular now in

China’s market. New brands, convenience stores and food delivery

services have displaced it. Also, these two brands’ market shares are

falling within the fast food sector itself. Euromonitor International

conducted a market survey that showed the market shares of KFC and

McDonald’s in China’s fast food industry have dropped to around 37

percent (24 percent and 13 percent for these two brands, respectively)

from a peak of 57 percent (40 percent and 17 percent, respectively).

Yum China and McDonald’s adopted different solutions to resolve this

dilemma. The former chose to separate from the global structure of Yum!

Brands and found an independent company — to whom it sold 20 percent of

the new company’s equity — while McDonald’s sold a 20-year franchise in

the Chinese market, including 2,200 franchised outlets in current

operation.

Both companies reaped massive funding from these deals, a vital

source for their next self-investments. The two firms also carry many

outlets in need of upgrade, since youngsters prefer comfortable,

fashionably-designed restaurants, regardless of menu. They also need to

digitize to lure consumers from a now-fragmented market. All these

circumstances clamor for massive funding.

Their methods of selling themselves differ in the extreme.

Yum China’s methods indicate its managers will still wield future

authority over the firm, whereas McDonald’s will switch to a new boss

for its Chinese team. Though whether this new boss will keep the team is

as-yet unknown, at least Su Jingshi, Yum China’s former chief executive

and senior McDonald’s managers who left office have received requests

from the investor team to stay on.

To revert to the question of why they sold their businesses, in the

two companies’ own words, “to sell yourself to improve the business” is

better than “to sell yourself at the highest premium.”

This is true.

Generally, franchise stores enjoy better business than direct-sales

stores because some belong to franchisees willing to lavish more

attention and money on running their stores. For instance, they promote

their shops with their own resources and better decorate them.

This idea is also applicable to companies.

The sale of Yum China and McDonald’s means that they have transferred

their franchise in the Chinese market to local teams, demonstrating

localization in such areas as product research and development, and the

decision to open outlets. Such localization won KFC a larger market

share than McDonald’s.

2. Why did the deals take so long — from the beginning until the end of this year?

Apart from continuous bargaining, no one Chinese company can digest

the huge businesses of McDonald’s and Yum China. The large amounts

bandied about in the deal spooked ele.me — an online food-booking

enterprise with rapid growth — into spontaneously quitting the bidding.

More important, although these two companies were anxious to sell their

businesses, they also cared about the buyers.

Ant Financial Services Group and Primavera Capital Group are the

buyers of Yum China. The former represents the possibility of developing

a simple off-line business into an O2O model. The latter indicated that

Yum China was looking for a company that better understands

investments. After buying into Yum China, Primavera Capital founder Fred

Hu (Hu Zuliu) became the firm’s new director. Yum China said, “This

indicates we have formed a strong and rigorous corporate governance

structure.” To learn the significance of the design of corporate

governance structures, the experience this year of China Vanke Co

(SHE:000002) is a good example.

McDonald’s has not found a satisfying investor yet, despite multiple

offers, because external capital is not only about money, but new

relations and competence as well.

The combination of CITIC Group Corp. and Carlyle Group LP (NASDAQ:CG)

is quite like the capital combination Yum China took in. As a

state-owned enterprise (SOE), CITIC represents ties with the government,

which was previously lacking in McDonald’s as aforeign

joint-venturebrand. This factor will play a significant role in the hunt

for new outlet resources. The key for all chain businesses is location.

Carlyle plays a role similar to Fred Hu in Yum China, namely for the

global capital needed by McDonald’s, which like Yum is also a US-based

company.

3. Why are investors making acquisitions in the sluggish fast food business?

‘Where’s the value?’ is a question confusing many people, including

those conducting negotiations with McDonald’s and KFC after the two

companies announced their intention to sell at almost the same time.

Potential investors are also left wondering which company’s shares offer

better value.

Yum complained about bidders’ low valuations, though nobody can

accurately determine the shares’ value. Yum director Keith Meister tried

to make clear that the offers only matched company revenues, rather

than its actual value, indicating investors greater concern over current

assets or profitability.

McDonald’s has over 2,000 outlets in China and Yum more than 7,000.

After expressing their intent to sell, buyers differed in their

interpretations of the reasons for the sale. Some consider how large the

fast food market’s potential is in the urbanization of China, while

other investors consulted company employees. One former executive

suggested the number of outlet stores each company has in prime

locations could influence investors.

Investors don’t decide based on the number of restaurants alone. Some

noted that acquiring Yum China does not confer on investors the right

to control the company, but investing in McDonald’s does. This is an

important difference that affects investors’ role within the company and

determines their ability to steer its direction.

Two other differences investors noted are leadership and marketing.

The former chief executive of Yum China led Yum for around 15 years,

whereas McDonald’s changes its head every three to four years. Investors

feel McDonald’s has better branding, but Yum is more innovative in

products and pricing.

4. Will we still be able to eat ‘authentic’ fast food?

Depending on your definition of authentic, you may never have eaten

authentic fast food in China. Products are localized here with flavors

altered to match local tastes. Both McDonald’s and KFC ply this practice

— like most companies. We need to look at the relationship between the

companies’ Chinese and global operations to understand how the sale will

affect products.

Once sold, Yum! China will become a franchisee of Yum! and be

authorized to operate all company brands and products, but may do so on a

different timeline than the rest of the world. Yum! China will also be

free to independently develop products for sale in its Chinese stores.

McDonald’s has not disclosed such information, so it is uncertain how

its menu will evolve, but it did say that McDonald’s China aims to

‘localize’ its food more, so the Chinese unit will likely be able to

customize its menu.

5. McDonald’s China said only a 20-year franchise is sold, so what happens 20 years from now?

To know what will happen in 20 years, look at the cooperation between

Starbucks Corp. (NASDAQ:SBUX) and Taiwan-based Uni-President Group Co.

After the expiration of their 20-year cooperation, the two companies

recently renewed their cooperative agreement — Uni-President develops

and operates Starbucks’s businesses in East China.

A brand franchiser cannot easily replace an operator who succeeds in

boosting business. Within 20 years, the operator may even change its

position within the cooperative relationship through sound business

performance.

Both CBN Weekly and YicaiGlobal

are owned by Chinese Business Network, the largest financial news group

in China. Over the past 13 years, CBN has dominated Chinese financial

media through radio, television, newspaper, magazine, new media,

information services, business research and other mediums. It is the

first choice of partner for the world’s top financial forums and

international economic organizations.